Micro, Small, and Medium Enterprises (MSMEs) play a vital role as ancillary units, complementing large industries and significantly contributing to the country’s inclusive industrial growth.

- Launched with Prime Minister’s vision of “Funding the Unfunded”, PMMY extends collateral-free loans to small enterprises that face significant challenges in accessing formal institutional credit: Union Finance Minister Smt. Nirmala Sitharaman

- PMMY is one of the most significant initiatives not only in India but also globally, aimed at promoting entrepreneurship: MoS Sh. Pankaj Chaudhary

- PMMY provides easy collateral-free loans up to ₹20 lakh for non-corporate and non-farm income-generating activities

NEW DELHI (India CSR): The Pradhan Mantri MUDRA Yojana (PMMY), launched on 8th April 2015 by Prime Minister Shri Narendra Modi, celebrates 10 glorious years of empowering small and micro-entrepreneurs across India. Aimed at fostering financial inclusion, PMMY provides easy collateral-free loans up to Rs. 10 lakh for non-corporate and non-farm income-generating activities. To strengthen support for aspiring entrepreneurs, the Finance Minister announced an increase in the loan limit to Rs. 20 lakh during the Union Budget 2024-25 on July 23, 2024. This new limit took effect on October 24, 2024. These loans are extended through Banks, NBFCs, MFIs, and other financial institutions.

The newly announced loan category, Tarun Plus, is designed specifically for those who have previously availed and successfully repaid loans under the Tarun category, allowing them to access funding between Rs. 10 lakh and Rs. 20 lakh. Additionally, the Credit Guarantee Fund for Micro Units (CGFMU) will now provide guarantee coverage for these enhanced loans, further reinforcing the government’s commitment to nurturing a robust entrepreneurial ecosystem in India.

Micro, Small, and Medium Enterprises (MSMEs) play a vital role as ancillary units, complementing large industries and significantly contributing to the country’s inclusive industrial growth. These enterprises are continually expanding their presence across various sectors of the economy, offering a diverse array of products and services to meet both domestic and international market demands.

The availability of credit for MSMEs has seen consistent growth, driven by advancements in technology and data-driven lending practices. A notable government initiative supporting MSMEs’ access to credit is the Pradhan Mantri MUDRA Yojana, aptly described as a scheme dedicated to “Funding the Unfunded”.

On the occasion of the 10th successful year of PMMY, Union Minister for Finance & Corporate Affairs Smt. Nirmala Sitharaman said, “The Pradhan Mantri MUDRA Yojana (PMMY) was launched by Prime Minister Shri Narendra Modi, with the mission of empowering hardworking micro-enterprises and first-generation entrepreneurs. Guided by the Prime Minister’s vision of “Funding the Unfunded”, the scheme extended collateral-free loans to bridge the gap in timely and affordable financing for small enterprises that faced significant challenges in accessing formal institutional credit.”

Highlighting PMMY’s role in Empowering Millions and Fulfilling the Vision of Inclusive Growth, Union Minister of Finance remarked, “With over Rs.33.65 lakh crore sanctioned to more than 52 crore MUDRA loan accounts, the scheme has proved to be an important milestone in giving wings to the aspirations of crores of entrepreneurs, particularly those belonging to marginal sections of society.

Since 2015, Rs.11.58 lakh crores worth of MUDRA loans have been sanctioned to various marginalised communities belonging to Scheduled Castes, Scheduled Tribes and OBCs realising PM’s mantra of ‘Sabka Saath, Sabka Vikas, Sabka Vishwas and Sabka Prayaas’”

Union Finance Minister Smt. Nirmala Sitharaman lauded the scheme’s impact with MUDRA: Fueling Women’s Entrepreneurship and Economic Growth, stating, “It is heartening to note that nearly 68% of the total MUDRA loan accounts have been sanctioned to women, becoming a tool for empowerment and enabling women to national economic growth, and inspire the next generation of female entrepreneurs.

In line with the Budget 2024-25 announcement, the introduction of the Tarun-Plus category last year, with an increased loan limit of ₹20 lakh, will further help thriving entrepreneurs expand and unlock their full potential.”

Here’s a shorter table of 10 key facts about Pradhan Mantri Mudra Yojana (PMMY):

| # | Key Fact | Details |

|---|---|---|

| 1 | Launch Year | 2015 |

| 2 | Objective | Provide loans to micro and small businesses |

| 3 | Beneficiaries | Small traders, shopkeepers, vendors, etc. |

| 4 | Loan Types | Shishu (up to ₹50K), Kishor (₹50K–₹5L), Tarun (₹5L–₹10L) |

| 5 | Loan Distribution | 40% Shishu, 35% Kishor, 25% Tarun |

| 6 | Implementing Body | MUDRA under SIDBI |

| 7 | Capital | ₹1,000 crore authorized, ₹750 crore paid-up |

| 8 | Partner Institutions | Banks, MFIs, NBFCs |

| 9 | Financial Goal | Promote inclusion and avoid debt traps |

| 10 | Total Beneficiaries | Over 34 crore (as per latest data) |

Let me know if you need a graphic version or caption for social media!

On the occasion, Union Minister of State (MoS) for Finance Shri Pankaj Chaudhary said, “The Pradhan Mantri MUDRA Yojana (PMMY) is one of the most significant initiatives not only in India but also globally, aimed at promoting entrepreneurship. Financial inclusion is one of the top priorities of the government, as it plays a vital role in achieving inclusive growth. PMMY provides a platform for small entrepreneurs to access loan support from banks, NBFCs, and MFIs.”

“While launching the scheme, Prime Minister stated that supporting India’s small entrepreneurs is one of the most effective ways to help the Indian economy grow and prosper. The scheme has provided crucial financial assistance to a vast number of entrepreneurs, helping them set up and operate their businesses and instilling a sense of financial security in them.

It has created self-employment opportunities across the country, especially for marginalized sections of society, including Scheduled Castes/Scheduled Tribes, Other Backward Classes (50% of loan beneficiaries), and women (68% of loan beneficiaries).” MoS added

Stressing on Mudra’s impact MoS said ” The core objective of the MUDRA Yojana is “Funding the Unfunded.” The scheme has successfully ended the exploitation of India’s small entrepreneurs by informal lenders. In less than a decade, it has extended over ₹33.65 lakh crore through 52.37 crore loans, instilling a new sense of confidence among borrowers. This clearly reflects the government’s firm commitment to support their efforts and its accelerated journey toward making India a developed nation by 2047 through inclusive growth enabled by financial inclusion.”

As we celebrate completion of glorious 10 years of providing financial inclusion through the pillars of Pradhan Mantri MUDRA Yojana (PMMY), let us glance through some of the major features and achievements of the Scheme:

The implementation of financial inclusion programme in the country is based on three pillars, namely,

1. Banking the Unbanked

2. Securing the Unsecured and

3. Funding the Unfunded

These aforesaid three objectives are being achieved through leveraging technology and adopting multi-stakeholders’ collaborative approach, while serving the unserved and underserved as well.

One of the three pillars of FI – Funding the Unfunded, is reflected in the Financial Inclusion ecosystem through PMMY, which is being implemented with the objective to provide collateral free access to credit for small/ micro entrepreneurs.

Key Features of PMMY:

- MUDRA loans now will be offered in four categories namely, ‘Shishu’, ‘Kishor’, ‘Tarun’ and newly added category ‘Tarun Plus’ which signifies the stage of growth or development and funding needs of the borrowers: –

- Shishu: covering loans upto Rs. 50,000/-

- Kishor: covering loans above Rs. 50,000/- and up to Rs. 5 lakhs

- Tarun: covering loans above Rs. 5 lakh and up to Rs. 10 lakhs

- Tarun Plus: Rs. 10 lakh and up to Rs. 20 lakhs

- Loans cover term financing and working capital needs across manufacturing, trading and service sectors, including activities allied to agriculturelike poultry, dairy, and beekeeping, etc.

- The interest rate is governed by RBI guidelines, with flexible repayment terms for working capital facilities.

Achievements under Pradhan Mantri Mudra Yojana (PMMY) as on 21.03.2025

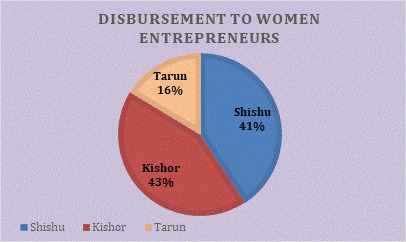

- Women Borrowers: A total of ₹ 8.49 lakh crore was disbursed under the Shishu category, ₹ 4.90 lakh crore under Kishor, and ₹ 0.85 lakh crore under the Tarun category.

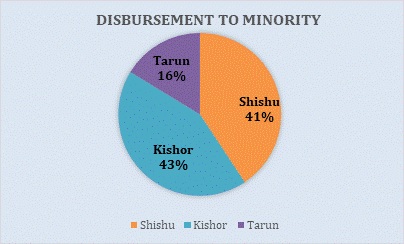

- Minority Borrowers: The disbursements amounted to ₹ 1.25 lakh crore under Shishu, ₹ 1.32 lakh crore under Kishor, and ₹ 0.50 lakh crore under Tarun.

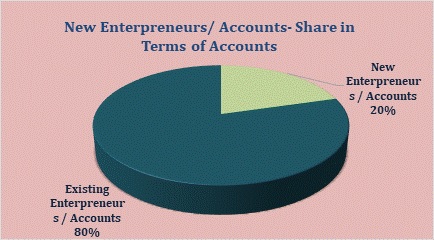

- New Entrepreneurs / Accounts:

- Shishu category: 8.21 crore accounts with a sanctioned amount of ₹ 2.24 lakh crore and disbursed amount of ₹ 2.20 lakh crore.

- Kishor category: 2.05 crore accounts with ₹ 4.09 lakh crore sanctioned and ₹ 3.89 lakh crore disbursed.

- Tarun category: 45 lakh accounts with a sanctioned amount of ₹ 3.96 lakh crore and ₹ 3.83 lakh crore disbursed.

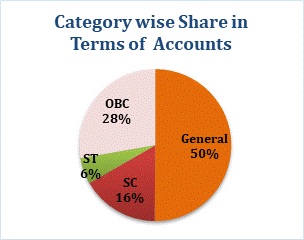

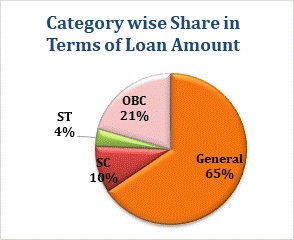

Category-wise breakup:- (Number of loans and amount sanctioned)

| Category | Percentage as per No. of Loans | Percentage as per Amount Sanctioned |

| Shishu | 78% | 35% |

| Kishor | 20% | 40% |

| Tarun | 2% | 25% |

| Tarun Plus | 0% | 0% |

| Total | 100% | 100% |

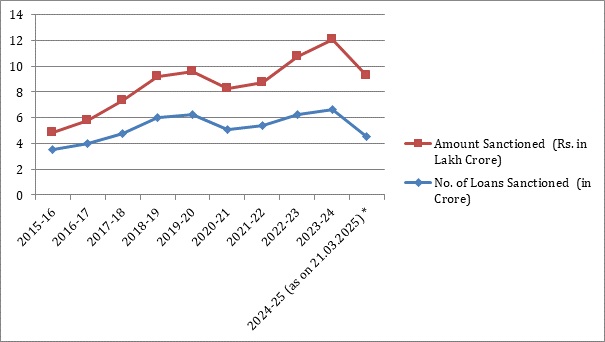

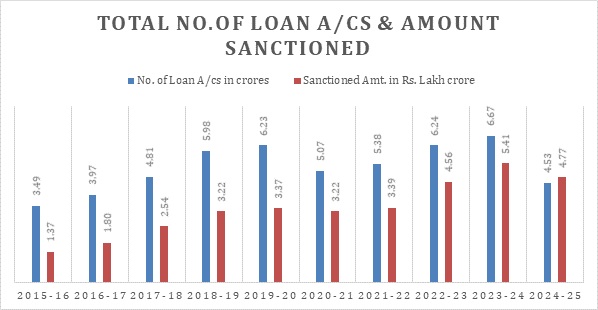

Targets have been achieved since the inception of the Scheme, except for FY 2020-21 due to COVID-19 pandemic.

Year-wise sanction amount is as under:-

| Financial Year | No. of Loans Sanctioned(in Crore) | Amount Sanctioned(Rs. in Lakh Crore) |

| 2015-16 | 3.49 | 1.37 |

| 2016-17 | 3.97 | 1.80 |

| 2017-18 | 4.81 | 2.54 |

| 2018-19 | 5.98 | 3.22 |

| 2019-20 | 6.23 | 3.37 |

| 2020-21 | 5.07 | 3.22 |

| 2021-22 | 5.38 | 3.39 |

| 2022-23 | 6.24 | 4.56 |

| 2023-24 | 6.67 | 5.41 |

| 2024-25(as on 21.03.2025) * | 4.53 | 4.77 |

| Total | 52.37 | 33.65 |

Special Initiatives:

- A Credit Guarantee Fund for Micro Units (CGFMU) was established in 2016 to secure loans under PMMY.

- An Interest Subvention of 2% was provided on Shishu loans during FY 2020-21 under Aatma Nirbhar Bharat Abhiyan, reducing the cost of credit for eligible borrowers.

As India celebrates 10 glorious years of PMMY, it reaffirms the government’s commitment to “Banking the Unbanked,” “Securing the Unsecured,” and “Funding the Unfunded,” fostering financial inclusion and supporting entrepreneurial dreams.

(India CSR)